Do you use your own mobile phone for work-related tasks? If you do, you may be able to claim a portion of your mobile phone expenses on your tax return.

Keep in mind, if you are claiming your work from home expenses using the 70c method, you cannot claim your mobile phone separately. Instead, by using the actual cost method, you can claim on the actual expenses incurred separately, such as your mobile phone.

Common work-related mobile phone tax deductions include:

- Phone calls

- Video calls

- Text messages

- Emails

- Logging in to systems

- Software testing

- Online research

- Tracking

It’s not just work-related phone calls that cost you money when you use your personal mobile phone for work, it’s everything else too! That’s why it’s worth getting all of your eligible phone expenses back each year.

How to claim work-related phone calls and other phone expenses on your tax return

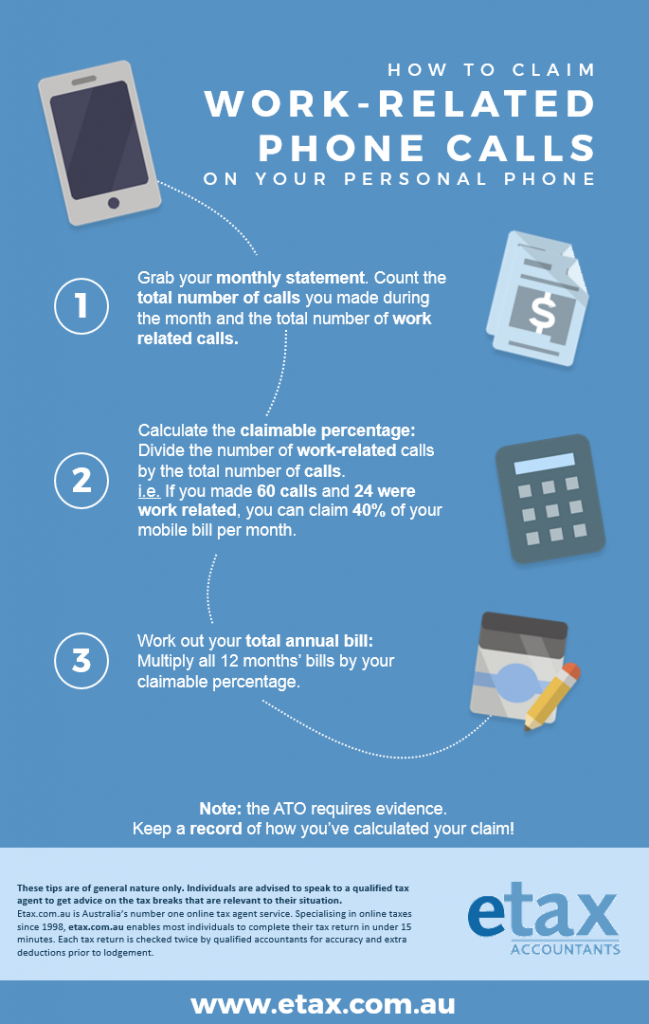

Claiming your phone expenses is not as simple as just uploading your monthly mobile phone bill and entering the total amount in your return. The ATO know you also use your phone for private use. So how do you claim work-related phone expenses the right way?

To start, you can only claim the portion of your phone use that is work related. You’ll need to work out what that percentage is, and you’ll need to keep records of those costs.

Can I include the cost of buying my phone in my phone expenses?

If you purchased a phone outright that you use partly for work, you can claim a percentage of the purchase price. If the phone was below $300 you can claim the business percentage of that amount as a one-off tax deduction. Or, if it was above $300, you claim the depreciation of the mobile phone over its lifespan, which the ATO states is two years from date of purchase. (Don’t worry about calculating this yourself! One of our expert accountants can calculate it for you).

What are the ways to claim phone expenses on your tax return?

- Calculate from a mobile phone plan.

- Claim work-related calls only.

- Claim costs from a bundled phone and internet plan.

1. How do I calculate my expenses from a mobile phone plan?

If you have a mobile phone plan, you can claim the work related portion of your phone use. Here’s how to do it for both itemised and non-itemised bills.

Itemised bills:

Work out the amount to claim by:

- Recording the number of work calls and the time spent on work calls.

- Recording the amount of data downloaded for work purposes.

Example: Ann is on an $80 per month phone plan that includes unlimited calls and 15GB of data. Her bill itemises her phone calls and provides her with her monthly data use.

Ann checks her phone bill and works out that the work-related calls make up 20%. She also estimates her phone data use to be 20% as she often checks and responds to emails on her phone. Therefore, she calculates the following:

20% (business use) × $80 (total bill) × 11 months (she had 1 month leave) = $176. Therefore, she can claim $176 in phone expenses on her tax return.

Non itemised bills

If your bill is not itemised, you can keep a diary for one month of all of your phone expenses. Etax provides a handy phone diary you can use here.

Example: David’s monthly phone bill is $50. Over a typical work month, David works out that 25% of his phone use is work-related (25 work calls ÷ 100 total calls). After taking a month of leave across the year, David calculates 25% × $50 × 11 months = $138. David can claim that amount as a phone expense on his tax return this year.

2. Just need to claim a few incidental work-related calls?

If your claim is less than $50 in total, you calculate the expenses at a nominal rate:

- $0.75 for work calls made from your mobile

- $0.10 for text messages sent from your mobile.

For claims over $50, the easiest way to work out how to claim work-related mobile phone expenses is by the method we describe in item 1 above. Choose a typical four-week period and record your work-related use. Then, apply that percentage to the whole year.

3. Need to calculate work-related costs from a phone and internet plan bundle?

It is common for households to have their phone and internet services bundled. If you need to claim expenses for work-related use of your phone and internet, you need to figure out your costs based on your work use for each. (Special note: If you share the cost of the bills with someone else in your household, you also need to apportion the amount you are claiming to only be “your share” of the bill, not the total amount).

Example: Carol lives by herself and has a $150 per month mobile phone and internet bundle. The bill shows that the monthly cost of the mobile phone service in her bundle is $65, and her internet service is $85.

Now that Carol has the value of each bundled component, she then calculates her work-related use for each item:

- Carol’s mobile phone use: 20% work-related use × $65 per month × 11 months (as she had a month of leave) = $143

- Home internet use: 50% work-related use × $85 per month × 11 months (as she had a month of leave) = $467.50

In her tax return, Carol claims a deduction of $610.50 for the financial year ($143 mobile phone use, plus $467.50 home internet use).

Need some help claiming your work-related phone expenses?

Claiming work-related calls and phone expenses can be confusing. But don’t worry! Just have a chat with one of our expert accountants when you’re doing your Etax tax return, they’re always happy to help you work out the right amount to claim.