Tax Return 2024

Your 2024 tax return is ready to go, at Etax!

The 2024 tax return is for income you earned between 1 July 2023 and 30 June 2024.

Etax has got you covered with new upgrades to make your 2024 tax return the easiest one yet. Most clients finish their tax return in less than 15 minutes! You can read down below about the ways that a 2024 tax return at Etax can help you get more back in your refund, get it done right, and avoid any appointments or bother.

Ready to lodge your tax return and get that refund?

It takes just a few minutes online, with live online support to help boost your refund.

With the help of qualified accountants who’ll get you the best possible refund, it’s no wonder Etax is Australia’s favourite online tax return.

You can start your 2024 tax return TODAY, at Etax.com.au.

Your 2024 tax return is easier than ever!

The team at Etax have been working non-stop to make the 2024 online tax return easier and nicer for you. When people tell us, “this part was hard for me”, we get to work to improve it.

For 2024, your tax return at Etax will be better than ever. Some people in past years have even told us that it’s fun (but, they might be accountants).

Will the new tax cuts give me a bigger tax refund in 2024?

The revised “stage 3 tax cuts” for 2024 may increase your take-home pay each week, but the changes won’t improve your next tax refund.

You can learn more about 2024 tax cuts right here: https://www.etax.com.au/stage-3-tax-cuts-explained

How to get a bigger tax refund in 2024

At Etax, your tax return will show an accurate tax refund estimate and help you find deductions to increase your tax refund.

How can you get a bigger tax refund?

Here are four important tips:

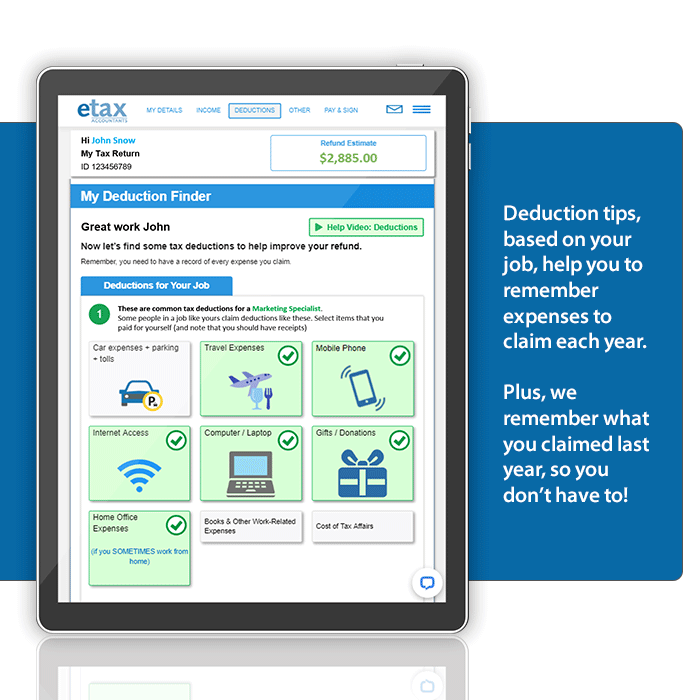

- Look at the Etax deduction section tips inside your tax return. Etax highlights the deductions that are related to your job, plus ones you’ve claimed before, to help you remember everything you are eligible for. (Plus, you can just chat with an Etax accountant if you have more questions).

- Keep track of tax deductions year-round.

Work-related tax deductions are an important way to improve your tax refund. Use Etax to save receipts and deductions anytime. Just login to your account and select the “add deductions or receipts for 2024 now” button to upload a receipt. It is then saved and ready for your next tax return. - Enter all of your income. This includes everything earned from your job, Centrelink, bank interest, rental property income and investment income. If you don’t add all of your income at the start, the ATO will find it later and you might get a lower refund than you hoped.

- The Etax Blog is a treasure-chest full of tips to boost your tax refund.

A good place to start is the “increase your tax refund” category.

Should I do my 2024 tax return online?

Thanks to Etax, doing your tax return online is incredibly easy. You get the same level of support as an old-fashioned tax agent, without having to make appointments and go out. And you don’t have to go it alone with the ATO. (Remember it’s the ATO’s job to collect revenue, not help you get a better refund!)

Etax improves its service every year based on your feedback. 26 years of upgrades means, Etax is a fast, user-friendly way to do your 2024 tax return. Etax gives you deduction tips based on your history and your occupation, helping you get a better refund.

All of that is wrapped-up together with phone and online chat support and a full-featured tax agent service. Here is a quick tour of the online tax return.

Ready to get your refund?

It takes just a few minutes online, with live online support to help boost your refund.

Should I use Etax as my tax agent?

For most Australians, the answer is “yes”.

According to the ATO, the majority of Australians use a tax agent, and that’s because…

- A tax agent is on your side.

- Tax agents like Etax have excellent online systems that save you time (with no appointments).

- You get friendly, expert help when you need it (at Etax that means you get help right now, by phone and live chat).

- You get the confidence it’s been checked and lodged correctly, by qualified people. (At Etax your return is reviewed twice before it is lodged electronically to the ATO.)

- We will try to increase your refund AND help you avoid ATO troubles.

- Etax fees are incredibly cheap, tax-deductible, plus most taxpayer’s refunds are higher when they use a trusted tax agent.

Can I get a quick tax refund estimate right now?

Yes.

You can use our tax calculator tool to estimate your refund here.

This will provide you with the best estimate for your next ATO tax refund.

Should I use myTax at the ATO?

The ATO has spent millions of taxpayer’s dollars on advertising, PR, media, consultants and marketing – trying to convince more people to use myTax.

Why? Well remember this key point: The ATO’s job is to collect more taxes, not give you get a better tax refund.

- If you want help to boost your refund and avoid ATO trouble, you’re better off doing your 2024 tax return with a tax agent service like Etax.

- For friendly support from a trained accountant who’s on your side, Etax is who you should talk to.

- If you have ATO problems later, and you used a tax agent like Etax, then your accountants will help you (but with myTax, you’re on your own if the ATO demands a tax repayment, penalty or reassessment).